Source: Bankless

Author: Jack Inabinet

Original Title: How Canton Network Works

Canton Network is quickly becoming the latest focus in the cryptocurrency industry. Does this signal a brewing explosive opportunity in a new wave of L1 ecosystems?

This blockchain, focused on real-world assets, recently made headlines for its high-profile integration with traditional finance giants (including the Depository Trust & Clearing Corporation DTCC and JPMorgan Chase), claiming to support over $6 trillion in on-chain real-world assets and a daily trading volume of $280 billion.

Today, we will delve into the technical architecture and token economic model of the Canton Network to better understand the design logic of this groundbreaking network.

Super Validator-Led Technical Architecture

Canton is essentially an interoperability layer connecting independent networks (these networks are also called "cantons"), with a design philosophy similar to the model in the Cosmos ecosystem that allows independent chains to communicate directly.

Regarding its consensus mechanism, the Canton Network is validated by an invite-only set of 13 "Super Validator" nodes, many of which are operated by the network's investors. One node is operated by the Canton Foundation, which is composed of early enterprise supporters, brand partners, and investors.

Most activity on the network occurs at the independent "canton" level, similar to how the Osmosis exchange in the Cosmos interoperability ecosystem aggregates the main liquidity and user activity. The validators of these independent cantons are responsible for processing all data on their independent "shard" and enjoy high flexibility in customizing the rules of that independent execution environment, including preferences for gas fees and data sharing.

Due to the inherently opaque design architecture adopted by Canton, the authenticity and sources of its published metrics (such as asset size and transaction volume) are difficult to verify independently.

However, representative independent application cases have emerged in the ecosystem: for example, the recently launched Temple Digital Group exchange, supported by YZi Labs, is operating as an independent Canton sub-network.

Token Economics

The Canton Network is built around its native utility token, Canton Coin (ticker CC), which is designed to "reward actual network usage rather than speculative behavior."

Similar to Ethereum, Canton burns tokens when users pay gas fees, creating deflationary pressure on CC. When the network is used for transactions, settlements, data synchronization, or asset transfers, all fees paid in CC are burned, permanently removed from circulation.

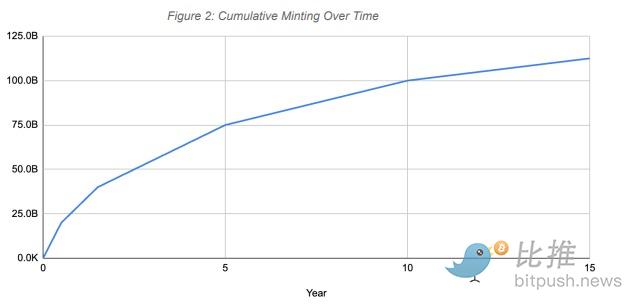

Similar to Bitcoin, Canton employs a programmatic token issuance curve, with regular halving events. New CC tokens can be continuously minted by various network participants by adding "measurable utility" to the network.

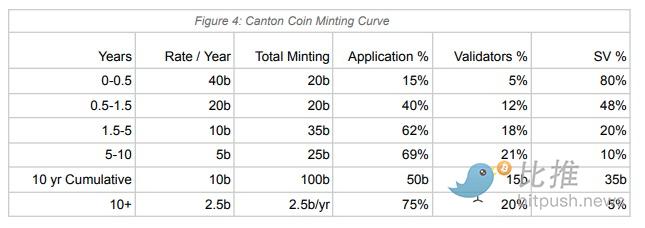

Currently, permitted Canton Super Validators (primarily early investors) are eligible for 48% of the CC issuance as a reward for maintaining global consensus. Validators receive 12% of the total CC supply, allocated mainly based on the value of Canton Coin transfers initiated by their users, and potentially rewarded based on node uptime if the minting cap allows.

Similar to Berachain, Canton also allocates tokens directly to applications in the form of gas fee rebates. "Featured" applications (which can be designated by Super Validators) can mint CC up to 100 times the burned fees, while non-featured applications can mint up to 80% of the burned fees.

It is worth noting that, at the time of writing, CC token minting is still proceeding according to the plan for years 0.5 to 1.5 in the chart below. However, with the second Canton halving scheduled to occur in just three days, the CC minting rate will soon be halved, and its distribution will be adjusted according to the plan for years 1.5 to 5 in the chart below.

For investors seeking trading opportunities, the supply reduction from the CC halving event may, through supply and demand dynamics, push the token price higher in the short term, regardless of the network's fundamental investment thesis.

Conclusion: A Glossy Narrative with Underlying Concerns

Canton undoubtedly presents a compelling investment story, but its potential opportunities are matched by outstanding questions.

Its highly configurable, privacy-focused design holds clear appeal for traditional finance giants, but the network's complex token economic structure and centralized control system introduce significant insider advantages, increasing the risk of imbalanced token distribution.

The permitted Super Validators, through their ability to designate "Featured" applications, continue to wield excessive influence over Canton's issuance. This means the flow of CC tokens will remain heavily controlled by insiders, even though this group's own issuance is set to decrease by approximately 80% within days.

The sudden rise of the Canton Network on the eve of its second halving adds another layer of suspense to the market. In the early halving phases, the supply shock effect is often most pronounced—while the upcoming emission cut for CC creates a clear catalytic opportunity for short-term trading, long-term investors should still view it with caution: the price impact from supply constriction should not be conflated with sustainable fundamental value.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush